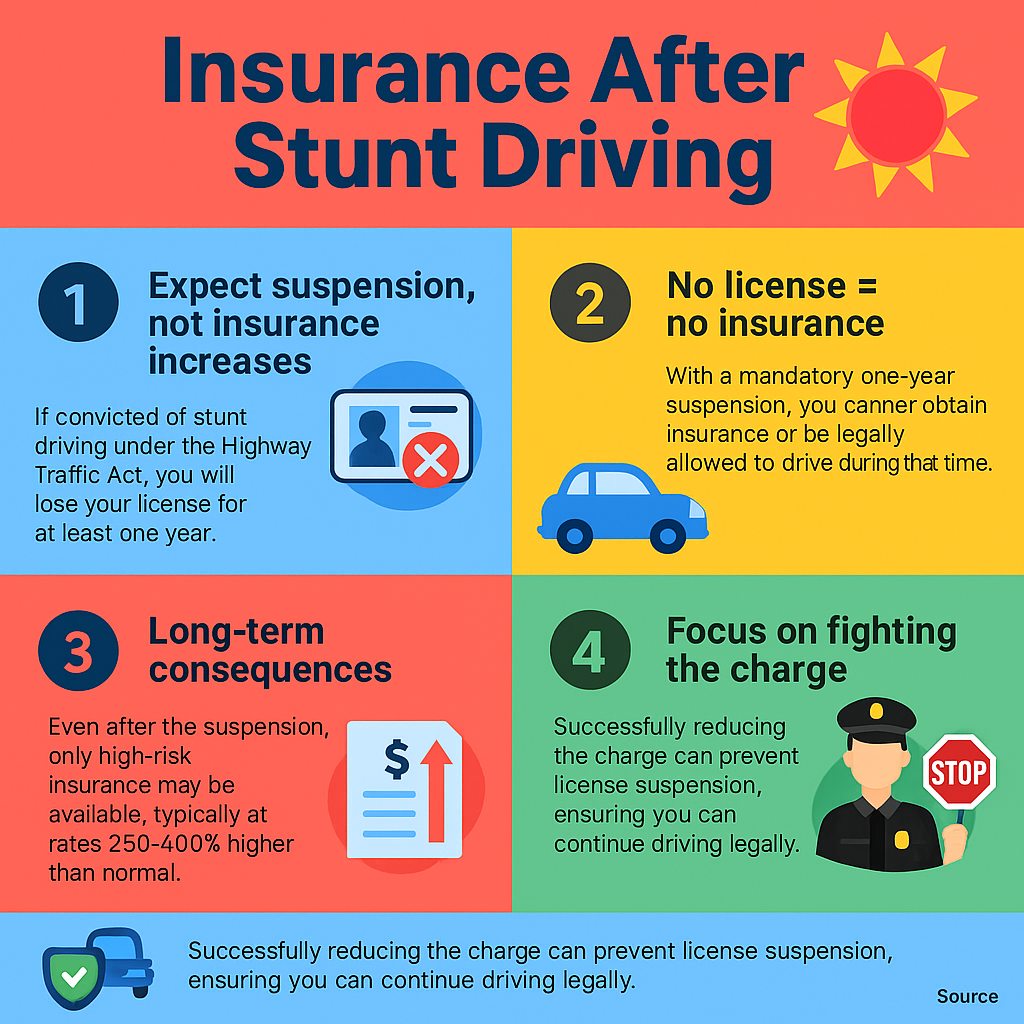

As someone who has defended thousands of stunt driving cases, I need to reframe this question entirely. If you’re convicted of stunt driving, insurance increases are the least of your concerns—you won’t even be able to drive or obtain insurance for at least one year due to the mandatory license suspension.

Let me be direct: the battle against a stunt driving charge isn’t about insurance rates. It’s about keeping your license. If you’re convicted, you lose your driving privileges for a minimum of one year under Section 172(1) of the Highway Traffic Act. During that time, insurance is irrelevant because you legally cannot drive.

The Reality Check: No License Means No Insurance

Here’s what actually happens with stunt driving convictions:

- Conviction = Mandatory 1-year minimum license suspension

- No license = No ability to obtain insurance

- Post-suspension = Facility insurance only (if you can find it)

- Years of astronomical rates (if anyone will insure you)

The real question isn’t about insurance increases—it’s about whether you’ll be able to drive at all.

Ontario’s Insurance Landscape: The Context

According to the Financial Services Regulatory Authority of Ontario (FSRA), Ontario already has some of the highest auto insurance rates in Canada:

| Year | Average Annual Premium (Ontario) | Year-over-Year Change |

|---|---|---|

| 2021 | $1,555 | -2.5% |

| 2022 | $1,655 | +6.4% |

| 2023 | $1,780 | +7.6% |

| 2024 (Q2) | $1,889 | +6.1% |

*Source: Financial Services Regulatory Authority of Ontario (FSRA)

High-Risk Driver Statistics in Ontario

The Insurance Bureau of Canada reports that drivers with serious convictions face severe insurance challenges:

- Only 3% of Ontario’s insurance market accepts high-risk drivers

- Facility Association (last-resort insurance) premiums average 250-400% higher than standard rates

- Many insurers require 3-6 years conviction-free before considering coverage

*Source: Insurance Bureau of Canada, 2023 Ontario Auto Insurance Review

The Success Scenario: Fighting the Charge

Here’s the crucial distinction: if you successfully defend against the stunt driving charge and it’s reduced to a lesser offence, yes, your insurance will likely increase—but you’ll still be driving. This is success.

Consider these alternatives to stunt driving conviction:

| Outcome | License Status | Insurance Impact | Ability to Drive |

|---|---|---|---|

| Stunt Driving Conviction | 1-year minimum suspension | No insurance available | Cannot drive |

| Reduced to Speeding 49 over | No suspension | +45-60% for 3 years | Can continue driving |

| Reduced to Speeding 29 over | No suspension | +25-35% for 3 years | Can continue driving |

| Reduced to Minor Speeding | No suspension | +10-20% for 3 years | Can continue driving |

Using Nextlaw’s Resources

Understanding the true stakes is critical. Our Stunt Driving Penalty Test helps you see beyond insurance concerns to the real issue: keeping your license.

For immediate strategic guidance, our Stunt Driving 24/7 Helpline focuses on the essential goal—avoiding conviction and maintaining your driving privileges.

Provincial Offences Court Data: The Volume of Risk

According to Provincial Offences Court data, stunt driving charges have exploded across Ontario:

| Year | Stunt Driving Charges | Potential License Suspensions |

|---|---|---|

| 2015 | 13,486 | Each facing 1-year minimum |

| 2021 | 27,602 | Each facing 1-year minimum |

| 2024 | 33,150 | Each facing 1-year minimum |

*Source: Provincial Offences Act Court Data (2015-2024)

Insurance Industry Data on Serious Convictions

FSRA’s 2023 market conduct review revealed:

- 68% of standard insurers automatically decline drivers with serious driving convictions

- Average time to return to standard market after serious conviction: 6-10 years

- Facility Association premiums in 2023 averaged $7,500-$12,000 annually

*Source: FSRA Market Conduct Annual Report 2023

Real Client Success Story

Dan and Jon were a life boat in a stormy sea that is not an understatement. I was looking at a real problem that would have effected me for the rest of my life I hired Dan and Jon and they took over my case from the very start they explained what to expect and the worse possible outcomes they then gave me what to expect from them. Every email was answered promptly and professionally they took care of all the details and made the impossible happen. If you need expert legal advise and representation for a driving offence these gentlemen will do the job. I would recommend them in a heart beat they are the very best at what they do period. – Stephen Brown

The Financial Reality of Not Driving

Based on Statistics Canada data, the average Ontario household spends:

- $11,000 annually on vehicle ownership and operation

- $3,500 annually on public transportation (for households without vehicles)

- $2,800 annually on taxi/rideshare services (urban households without vehicles)

*Source: Statistics Canada, Survey of Household Spending, 2022

The cost of alternative transportation during a one-year suspension often exceeds any insurance increase you might face with a reduced charge.

Post-Suspension Insurance Reality

For those who are convicted and serve their suspension, the insurance landscape is bleak:

- Standard insurers typically require 3+ years conviction-free before considering coverage

- Facility Association remains the only option for most

- Annual premiums of $8,000-$15,000 are common

- Some remain uninsurable at any price

The Strategic Focus: License Preservation

The message is clear: insurance increases are a luxury problem. If you’re convicted of stunt driving, you won’t need insurance because you won’t have a license. The entire focus must be on avoiding conviction to preserve your driving privileges.

Yes, a reduced charge may increase your insurance by 25-60%, but you’ll still be driving. That’s victory. The alternative—conviction and mandatory suspension—means no driving and no insurance options for at least a year, followed by years of facility insurance if you can get it at all.

Redefining Success

Success in a stunt driving case isn’t avoiding insurance increases—it’s avoiding conviction and keeping your license. An insurance increase of even 100% is infinitely better than losing your license for a year and potentially being uninsurable afterward.

The battle isn’t about insurance rates. It’s about your right to drive. Focus on the real goal: avoiding conviction and maintaining your driving privileges.

For a realistic assessment of your case and the best strategy to preserve your license, use our Stunt Driving Penalty Test or contact us immediately through our 24/7 Helpline.

Remember: with proper legal strategy, an insurance increase means you’ve won—because you’re still driving.

*Disclaimer: All statistics cited are from publicly available sources including FSRA, Insurance Bureau of Canada, Statistics Canada, and Provincial Offences Court data. Insurance rates and availability vary by individual circumstances.